Scoring Models

We Support

A unified scoring framework for lenders, debt-relief companies, fintechs, and credit-decision platforms.

- CreditPullEngine – Home

- Products

- Scoring Models

One Pipeline

Zero Complexity

Scoring Models Built for Smarter

Credit Decisions

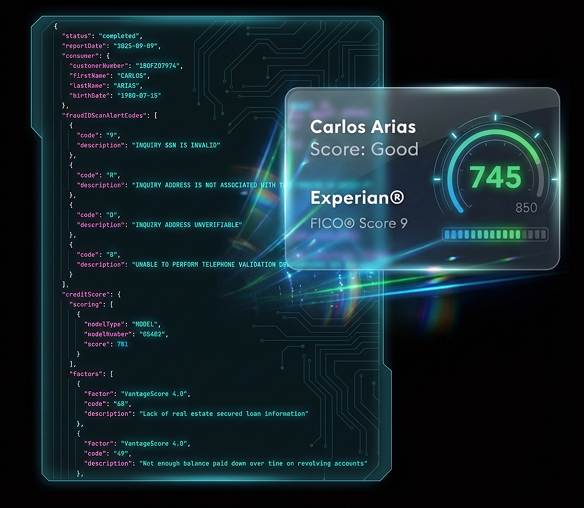

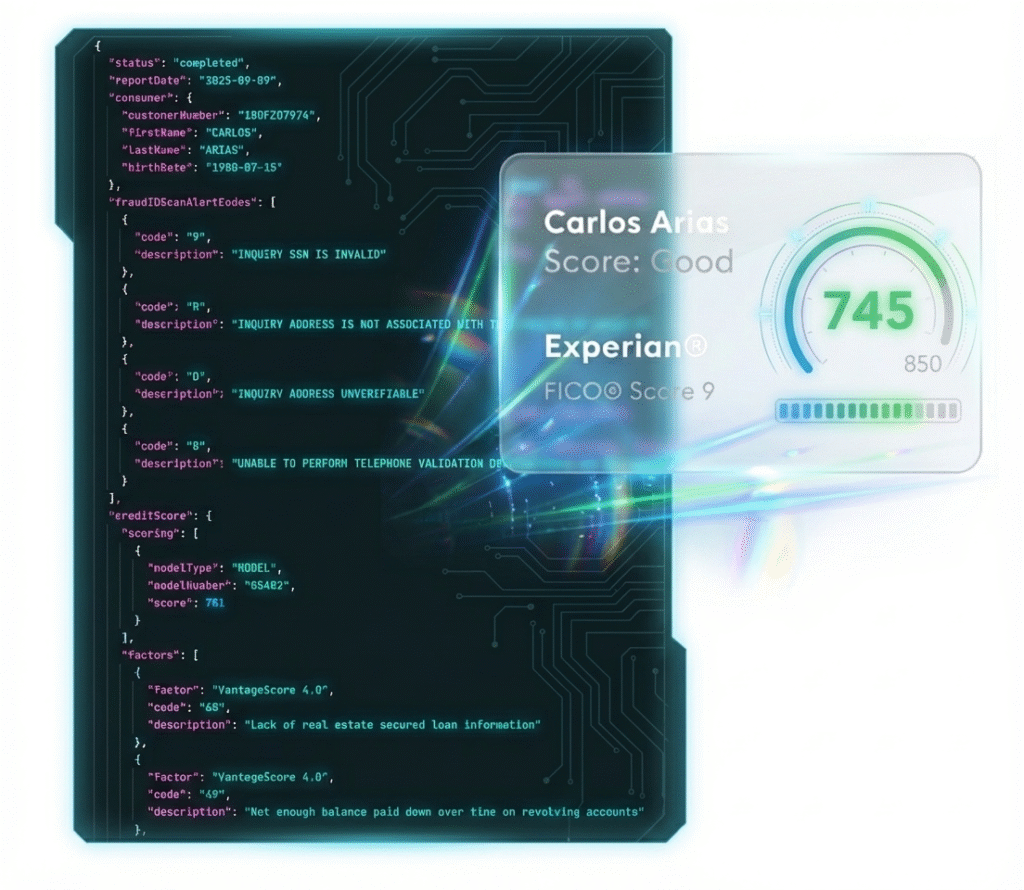

CreditPull Engine gives you standardized access to the industry’s most widely used consumer scoring models, including FICO and VantageScore, across Equifax and TransUnion. Our platform normalizes the raw bureau data, harmonizes score fields, and delivers everything in a consistent JSON format so your underwriting and credit-analysis workflows stay clean and predictable.

Scoring Model

Supported

FICO Score

Trusted industry

standard for credit risk evaluation

FICO Score models remain the industry standard for evaluating consumer and business credit risk. CreditPull Engine supports multiple FICO versions, including FICO Score 2, 5, 8, 9, 10, 10T, and FICO SBSS for small-business underwriting. Our platform normalizes scoring outputs across bureaus, enabling consistent and reliable risk assessment for lending, tenant screening, auto financing, and debt-relief workflows.

Scoring Model

Supported

VantageScore

More inclusive scoring

with broader consumer coverage

VantageScore provides a modern, inclusive credit scoring approach designed to evaluate more consumers, including those with limited or emerging credit histories. CreditPull Engine supports VantageScore 3.0 and 4.0, delivering consistent tri-bureau scoring with improved handling of paid collections and optional trended data. These models offer broader coverage and flexible decisioning intelligence for lenders, fintechs, tenant screeners, and debt-relief platforms.

Your Research Process

is Costing you profits.

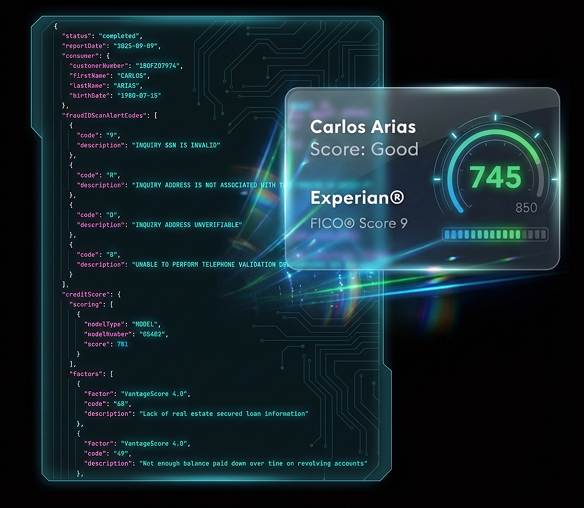

Agents waste hours interpreting messy credit reports—draining productivity and profit.

Our AI-powered Credit Intelligence standardizes every report automatically, giving agents actionable clarity in seconds and saving your business thousands per month in wasted labor

“Finally, a platform that removes guesswork. CreditPullEngine completely transformed our workflow. Clean, standardized reports saved us hours per client, cut costs dramatically, and helped our agents close more settlements with confidence.”

Steve B.

Debt Relief Agent