Empowering Startups with

Real-Time Credit Intelligence

Over 1 million API calls have been requested since 2024.

Trusted by startups. built for scale.

Real numbers. Real impact. See how CreditPulleEngine empowers fast-growing fintech companies.

CreditPullEngine

Powerful Features

to

Build & Scale Effortlessly

Build smarter financial products with secure access to trusted credit data sources. Use our API or our agent-friendly dashboard to pull reports, analyze results, and integrate credit intelligence into your workflow.

- Formal

- Friendly

- Persuasive

- Funny

- Professional

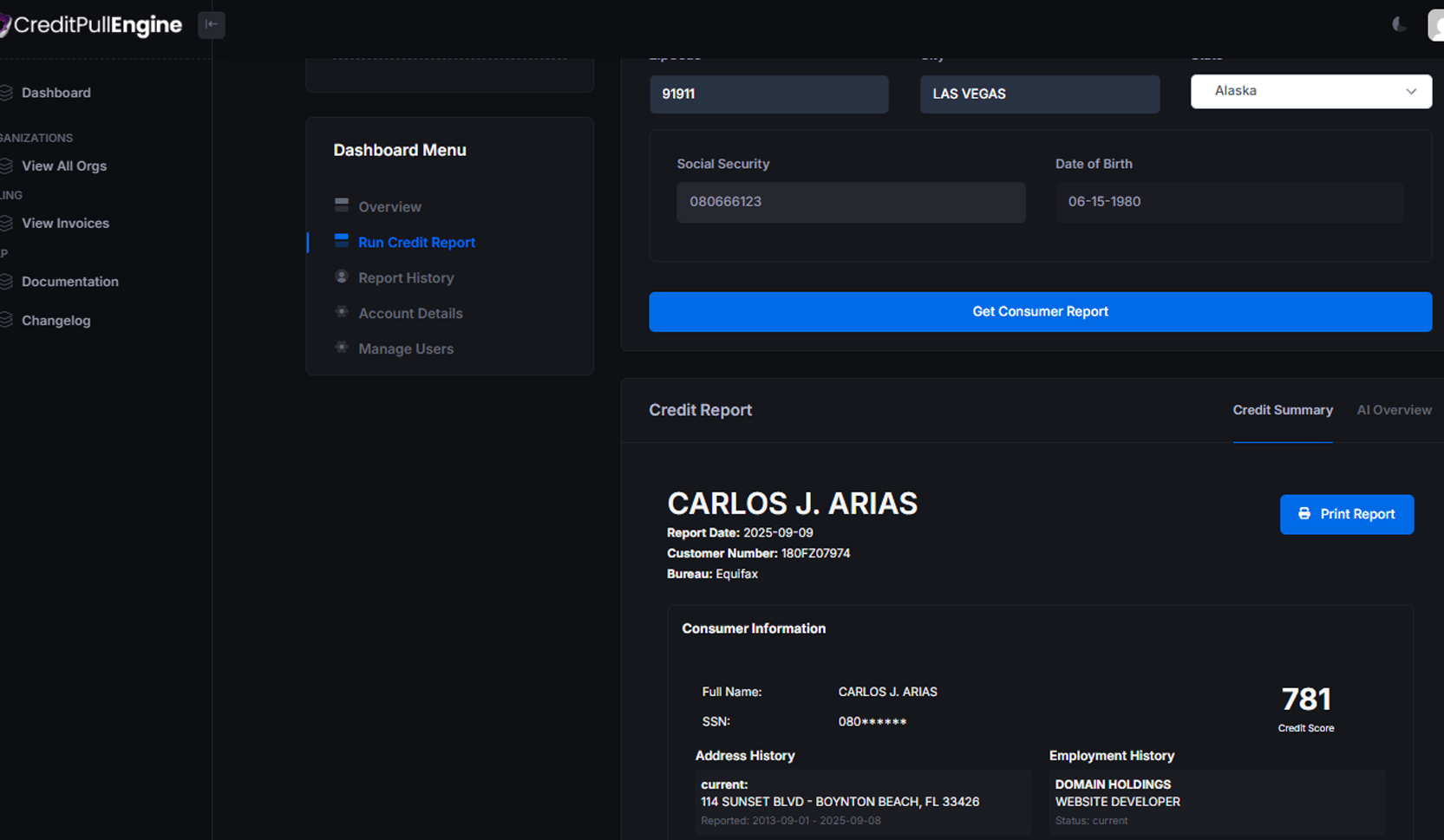

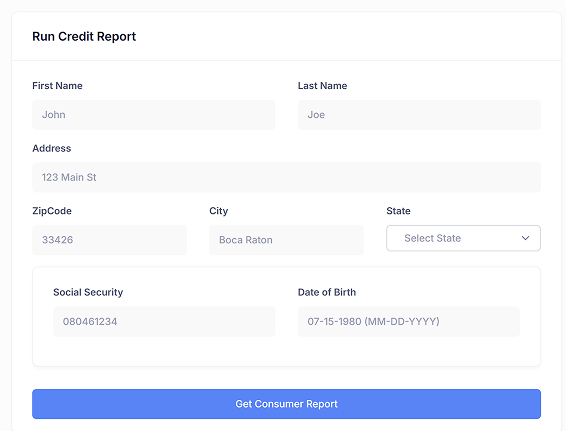

Instant Consumer Report

Retrieve consumer credit reports in seconds from trusted data sources using our secure platform or API.

credit score analysis. help your clients build their report effortless and less paperwork

Intelligent Debt Analysis

Our proprietary intelligence engine transforms structured credit data into secure, strategic debt-planning.

- Manager

- Debt Agent

- Financial Advisor

- Admin

Team & Role Management

Manage roles, and control access to keep your entire organization operating in a secure environment.

- Consumer Data

- Public Records

- Derogatory Summary

- Credit Summary

- Mortgage

- Credit Cards

Customizable Workflows & Integrations

We partner with your engineering team to create tailored endpoints and workflows, ensuring the platform adapts to your product, not the other way around

-

Secured API Request1

-

Normalized JSON Response2

-

Your Platform or CRM3

Developer-Ready API Integration

Integrate credit data directly into your software using our unified API, delivering clean, standardized credit intelligence that accelerates development and eliminates the pain of handling raw bureau data.

Easy Onboarding

just in 3 Steps

- 01 Company Verification Basic paperwork verifying your company information and address.

- 02 Office Verification You will need to show a secured office it can be Business office or home office.

- 03 Credentials Once approved you will get your credentials to access our API & Platform. During the onboarding process you can request for Sandbox credentials to get started.

Let us worry about Security & Compliance

so

you can focus on growth.

Let us worry about compliance and security, and you can focus on growing your business and streamlining your under writing process and helping your customers.

- Compliance

- Cloudflare

- Security Layer

Maximize Results, Minimize Effort

Reliable Credit Data Access

Instant access to trusted consumer data sources through a secure platform or API designed for financial and debt-related workflows.

Faster Approvals

Get onboarded quickly with a streamlined approval process built for agencies, advisors, startups, and fintech teams.

Focus on Your Product, Not Integrations

We handle the data complexity, compliance, and formatting so you can focus on building features that grow your business.

Scales With Your Team

Easily manage agents, roles, and permissions as your organization expands, without adding operational friction.

Flexible, Commitment-Free Pricing

Use CreditPullEngine on your terms with no contracts, no monthly minimums, and no long-term commitments. Pay only for what you pull, nothing more.

Custom Solutions That Adapt to You

Our engineering team collaborates with yours to create custom endpoints, workflows, or features tailored to your platform.

Success Stories

from Businesses Like Yours

Don’t just take our word for it – see how our platform is being used with other businesses like yours, from Fintech, Debt Settlement and Credit Counselors.

We go beyond products

we build, support, and scale your startup journey.

At CreditpullEngine is a team of engineers that are driving digital intelligence through AI, Data and Cloud. With over 25yrs years of experience in Fintech, and SaaS Development we build smart scalable solutions that help enterprises move beyond digital transformation into intelligent, data -driven growth.

Custom Development

When you need something built your way, our engineering team delivers custom features, tailored endpoints, and platform-specific workflows that align with your product vision.

Integration Support

We don’t just hand you an API — we help you integrate it. Many teams spend months doing what we can complete in a fraction of the time, saving you money and momentum.

Technical Partnership

Not sure how to structure your workflow or scale your system? We work directly with your developers to architect clean, reliable, and future-ready solutions

App & API Integration

Seamlessly connect your platform with our API or third-party services. We handle the technical work so your team can launch faster with fewer headaches.

4.9/5

Watch CreditPullEngine Do It’s Magic

Video tutorial on how to integrate with CreditPullEngine API service.

Quick Response & Assistance

We're available at almost time of the day for any questions you have with integration or help with your engineering project

Fast API Integration

We try to make it seemless to help you integrate our API into your project.

Engineer to Engineer

We worked with developers and engineers with multiple integration projects.