Easy Integration to

Consumer Credit Data

Consumer credit data drives every major lending and financial decision. CreditPullEngine gives you instant, standardized access to high-quality consumer credit information, helping you reduce risk, verify identity, and move borrowers through your workflow without friction.

- CreditPullEngine – Home

- Products

- Consumer Reports

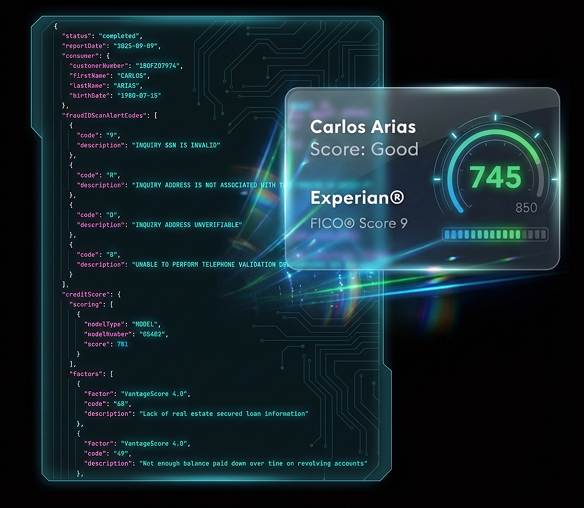

Credit Data Aggregated, Standardized,

and Delivered Through One API

A credit report provides a detailed view of a consumer’s financial history, tradelines, payments, inquiries, public records, and scores, helping businesses assess risk, verify identity, and make informed lending or eligibility decisions.

Seamless Credit Workflows From One API

Integrate credit reports and supplemental data directly into your CRM, LOS, or custom platform. CreditPullEngine works seamlessly with third-party systems commonly used in debt settlement, fintech, lending, and legal workflows

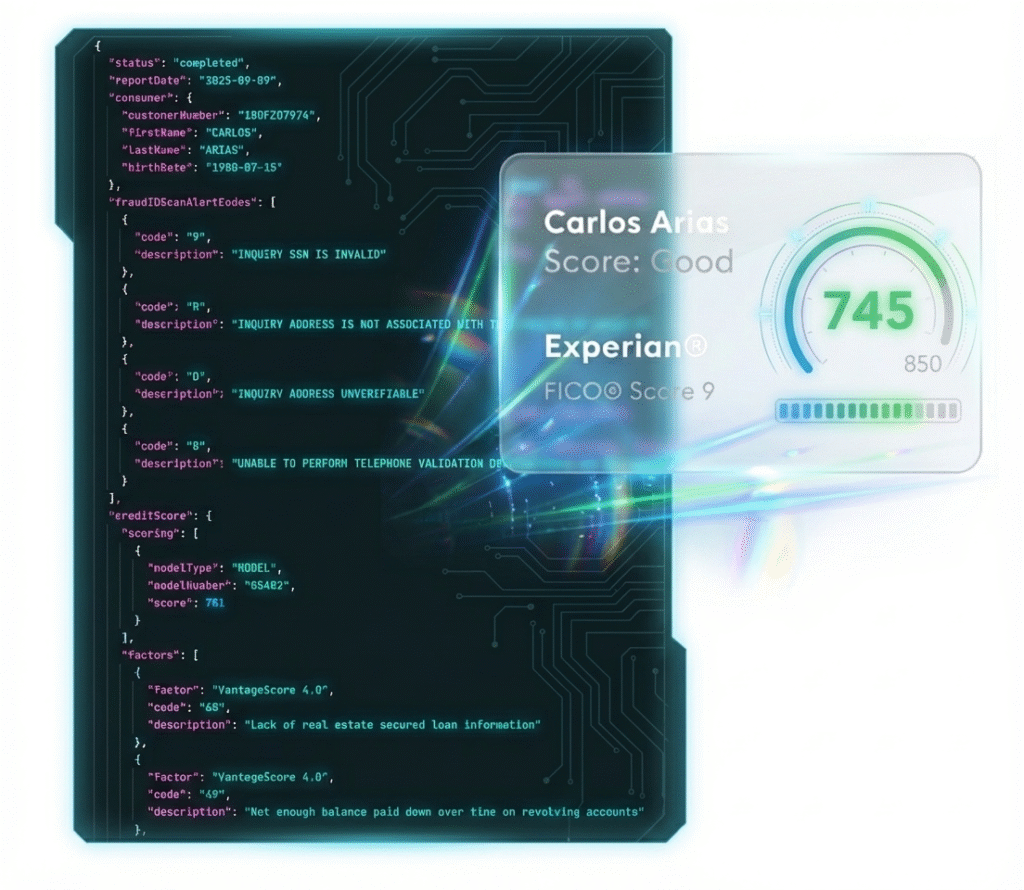

Your Research Process

is Costing you profits.

Agents waste hours interpreting messy credit reports—draining productivity and profit.

Our AI-powered Credit Intelligence standardizes every report automatically, giving agents actionable clarity in seconds and saving your business thousands per month in wasted labor