Consumer Reports for

Debt Relief & Debt Management Agencies

Pull consumer reports instantly into your debt management platform. Our unified format eliminates manual data entry, simplifies analysis, and gives your agents the clarity needed to create accurate, compliant settlement strategies.

- CreditPullEngine – Home

- Industries

- Debt Relief

Stop Guessing.

Start Settling Faster

- No Monthly Minimums

- No Contracts

Get Credit Reports built for Debt Relief so your team settles faster

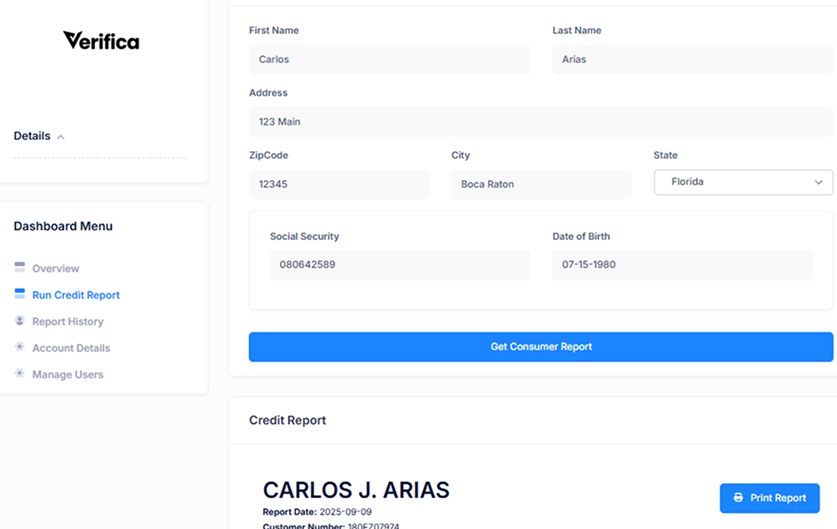

Pulling and interpreting credit data shouldn’t take hours. CreditPullEngine standardizes messy consumer data from trusted sources and turns it into clean, decision-ready insights, instantly highlighting derogatories, balances, histories, and risks so agents can build stronger settlement plans in minutes, not hours or days.

Pulling consumer credit data for debt relief shouldn’t be a hassle. Our Credit API integrates directly into your platform, delivering structured credit data instantly and feeding it into your automated analysis or enrollment workflows.

We aggregate standardized data from trusted data sources, including scores and attributes used across debt-relief decisioning. For teams needing deeper insight, we also support additional data signals such as income indicators and asset-related attributes.

To protect your business and ensure accurate consumer evaluation, we provide integrated identity-verification tools, helping you confirm consumer identity and maintain compliance before any debt-relief action is taken.

Key benefits include:

- Fast access to standardized data from all major sources

- Multiple score and attribute options

- Soft-pull prequalification without impacting credit

- Income, asset, and alternative-data verification

- Instant delivery through our API in seconds

Talk with our team to see how easily you can pull consumer credit data and power your Debt Relief workflows with a single, streamlined API

Your Research Process

is Costing you profits.

Agents waste hours interpreting messy credit reports—draining productivity and profit.

Our AI-powered Credit Intelligence standardizes every report automatically, giving agents actionable clarity in seconds and saving your business thousands per month in wasted labor

Why Debt Management

Companies Choose CreditPullEngine

We’re #1 Solution for Debt Management companies in the US.

- Formal

- Friendly

- Persuasive

- Funny

- Professional

Compliance & Security

We manage compliance and end-to-end security, keeping your operation safe and audit-ready

Debt Settlement Opportunity. was found in the reporting, we have compiled some strategies.

Soft Credit Reports

Pull prequalification credit reports without hurting credit scores, giving you risk clarity with no consumer impact.

- XML

- HTML

- XML

Format Customization

Flexible PDF, JSON, and HTML credit report formats designed to fit any workflow or system needs.