Credit Reports for Auto Lending

- CreditPullEngine – Home

- Industries

- Auto Loans

Stop Guessing.

Start Settling Faster

- No Monthly Minimums

- No Contracts

Instant Credit Reports for Smarter Auto-Lending Decisions

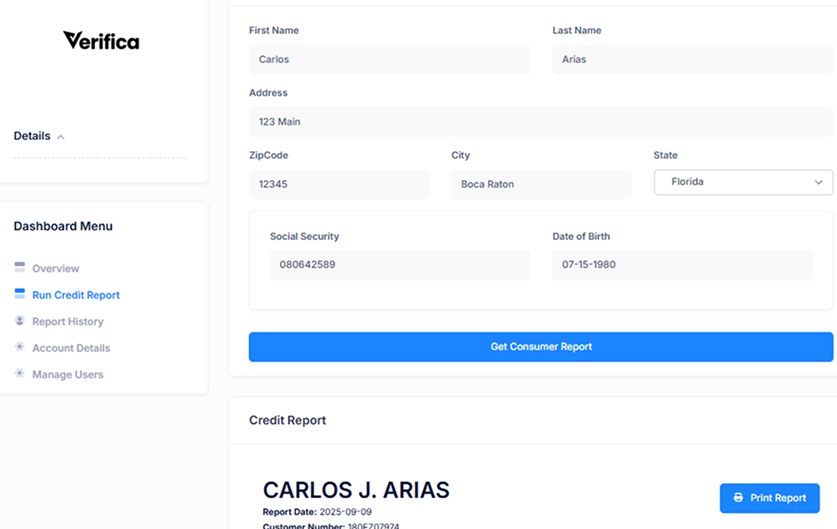

Access real-time automotive credit data through one unified connection. CreditPullEngine standardizes every data source into a clean, consistent format that drops directly into your auto-lending workflows, no manual parsing, no integration headaches, no delays.

Lenders get immediate visibility into consumer credit profiles, alternative data, and income signals, all delivered in a structured format built for automated underwriting and decisioning systems. Identity and verification checks are built into the process, ensuring every application is accurate, authenticated, and ready for a compliant lending decision.

- Instant access to multi-source credit data in one standardized format

- Multiple score types and attributes to support precise underwriting

- Soft-pull prequalification with zero friction

- Integrated identity, income, and asset verification

- Real-time API delivery optimized for decision engines

Talk with our team to see how easily you can pull consumer credit data and power your Debt Relief workflows with a single, streamlined API

Your Research Process

is Costing you profits.

Agents waste hours interpreting messy credit reports—draining productivity and profit.

Our AI-powered Credit Intelligence standardizes every report automatically, giving agents actionable clarity in seconds and saving your business thousands per month in wasted labor

Why Dealerships &

Auto-Lenders Choose CreditPullEngine

We’re #1 Solution for Debt Management companies in the US.

- Formal

- Friendly

- Persuasive

- Funny

- Professional

Compliance & Security

We manage compliance and end-to-end security, keeping your operation safe and audit-ready

Debt Settlement Opportunity. was found in the reporting, we have compiled some strategies.

Soft Credit Reports

Pull prequalification credit reports without hurting credit scores, giving you risk clarity with no consumer impact.

- XML

- HTML

- XML

Format Customization

Flexible PDF, JSON, and HTML credit report formats designed to fit any workflow or system needs.