Our Mission. Redefine

Financial Decisions Through Credit Intelligence

Trusted by Credit Counselers & Law Firms throughout the United States

AI Engineering & Fintech Coming Together.

CreditPull Engine was born out of a simple frustration shared by every debt-relief and credit-services business owner — too much data, too little clarity.

After years in the industry, we saw the same pattern repeat: agents buried in credit reports from different bureaus, manual spreadsheets, and time-consuming analysis that slowed down client onboarding and compliance. Every firm had talented people, but they were spending hours interpreting data instead of helping clients.

That’s when we decided to build something better.

Combining deep FinTech experience with modern AI engineering, we created CreditPull Engine — a platform designed to turn complex credit data into instant, actionable intelligence. By automating credit report interpretation, standardizing data, and applying AI-driven insights, we’re helping debt-relief professionals focus on what actually matters: guiding clients toward solutions.

Our mission is simple. remove the bottlenecks, automate the process, and make data work for you, not against you. Because when information flows seamlessly, businesses scale faster, compliance gets easier, and clients get the help they need without the wait.

Built on Integrity. Driven by Innovation

Innovation with Purpose.

Not Just Hype.

People Before Processes. Always

Behind every data point is a person. Our technology exists to empower professionals who serve day to day financial challenges.

Work. Grow. Repeat.

From team hikes to virtual game nights, we keep the vibe alive—wherever we are. Because fun fuels creativity.

“Brighthub’s not just about what we build — it’s about how we celebrate building it together.”

— Carlos Arias, CTO & Co-Founder

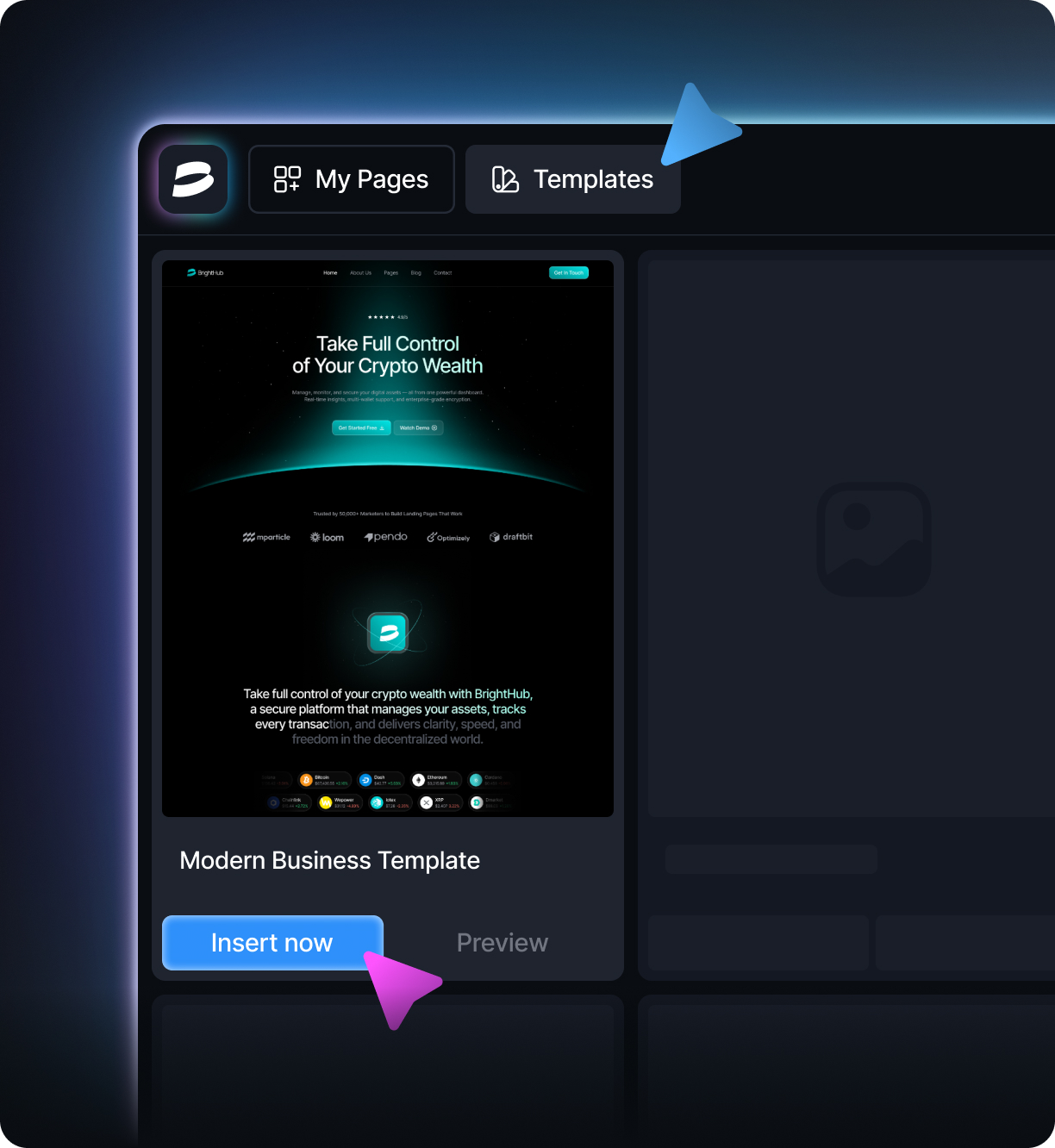

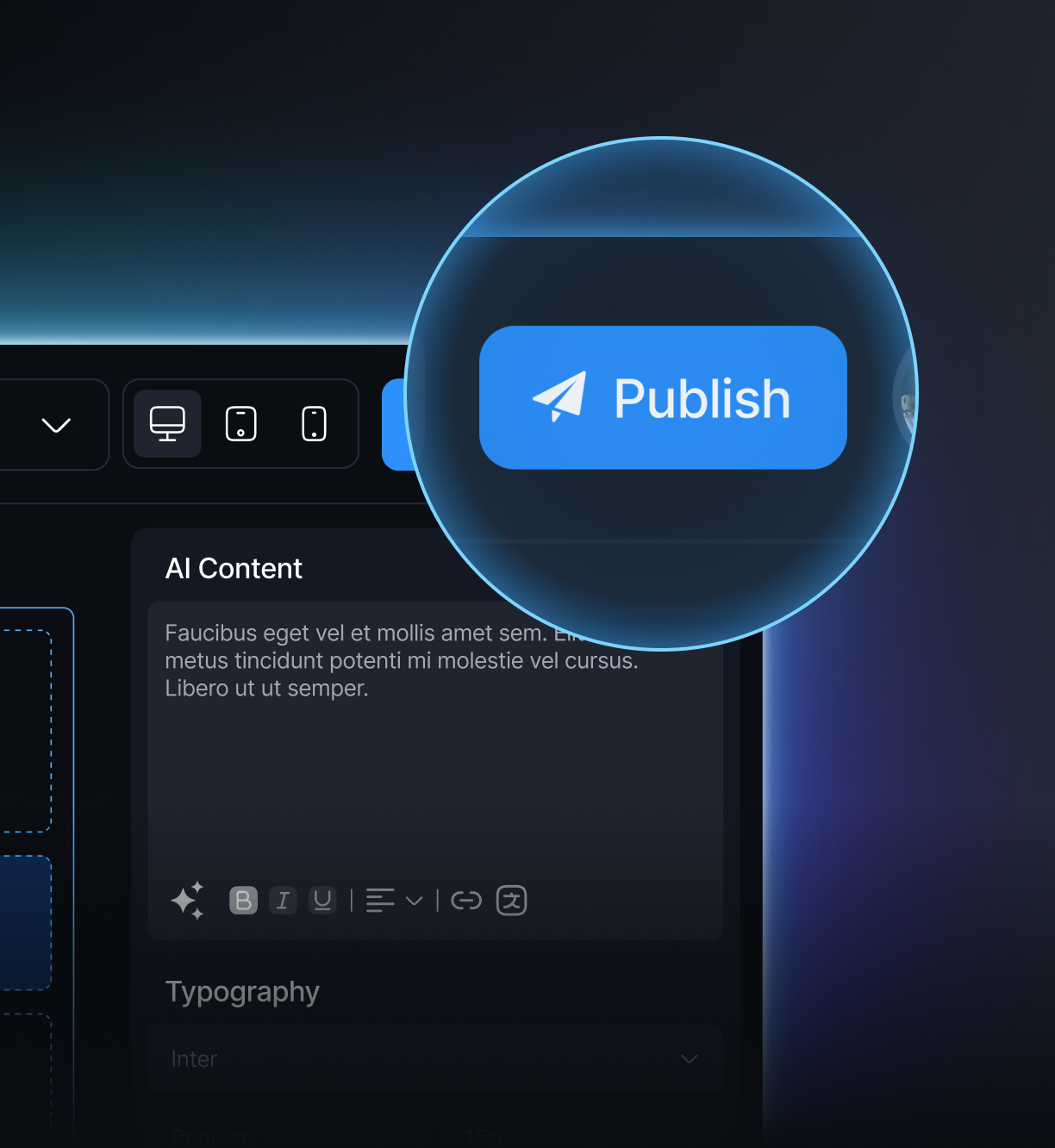

Credit Intelligence in Pages in 3 Steps

- 01 Consumer Information Using our API or Platform enter the consumers information in our system.

- 02 Consumer Verification Consumer verification process is controlled by the consumer for compliance.

- 03 Verified & Report Once consumer verify their information or provides approval of the report. The agent will have access to the consumer’s report.

Success Stories

from Businesses Like Yours